The ESG Update, Vol. 9

- Julie Skye

- Feb 18, 2019

- 4 min read

Updated: Apr 22, 2019

4 Things You Need to Know About “9th Inning” Investing

1. Some Assumptions Do Matter

Every fall economists evaluate how last year’s assumptions and predictions turned out and project expected earnings for the next 3-5 years. My goal is to answer the question “What could be different next year?”

What is 9th Inning Investing? Some years the game just started and there are few changes to last year’s lineup — the mood is hopeful. But if we've just come through a rough patch, the focus is on how you are feeling and if you got through the last inning without too many bruises. We’ll affirm your risk tolerance, and make sure you are invested in a portfolio that fits where you are today.

Then there are the 7th inning stretch years with congratulatory pats on the back. Meetings are short and sweet, and the focus might be on what has changed in your life. I’ll spend more time on last year’s tax return and set up your income plan for the next year. The spirit is light, and we might shift our focus to your financial plan.

And then there are the years where some very different thinking is needed and this is 9th Inning Investing. We recognize it by the return of volatility and there could be warnings the game might be called due to bad weather. Even if we go into extra innings, everyone knows that the end of the game is approaching!

What does 9th-Inning Investing look like in portfolios?

You will see more warnings in my newsletters and blog.

Our Meeting Agendas will focus on how you are feeling and what cash you’ll need for the next year.

You will see confirmations as we take profits or sell a fund that no longer fits.

You will have more cash than normal.The market will start practicing for the top by inflicting us with “pre-bear-market-mini-crashes.”

Think of the two corrections in 2018 as “practice” for the big one that is out there sometime in the future! How can you tell when I think the 9th inning is close to winding down? Cash becomes King.

2. Pull Out Your “Quilt” When Stormy Weather Threatens

One of my favorite ways to see that asset allocation matters is the “Quilt Chart,” produced by Callan, the king-of-investing-past-and-present. Nothing captures the fact that every asset class’s performance changes according to the inning you are in like these full-color charts do.

Check out the 2018 Quilt Chart here. If you wondered why there was so much red in your portfolio last year, this explains it. Cash was indeed the king!

Pick an asset class — any asset class — and trace your finger over the years. Notice that every single asset class’s performance changes depending on what inning you are in. When you see the past decade of returns, you will understand the value of letting the past help guide you.

Look for my mailing in early March that has a hard copy of this 2018 Quilt Chart, the Quarterly Meeting Agenda, the 2018 Year-End First Affirmative newsletters, and your 2019 tax folder. Spend some time on this Quilt Chart — pick a “color” (an asset class) and follow it as it travels through the different market cycles. If ever there was living proof that “buy and hope” means you will suffer more volatility than you should, this is it.

3. Asset Allocation Re-Boot

Are you stuck in the past when you think what the next few years are expected to look like? Don’t expect the 10% stock gains / 5% bond dividends to reappear in the next few years.

Your actual returns determine the line graph on your Right Capital Financial Plan and confirm your spending level is not too high OR too low. Make 2019 the year your financial plan is #1 on our TO-DO list. As we complete your plan and stress-test your withdrawal rate with my new piece of software, TimeLine, you will have more confidence what your number is to withdraw...and you will be able to exhale.

4. Are We There Yet?

You would have to have a short memory to have forgotten the nine-day, 10% sell-off in the S&P 500 last January 2018. It took the market 241 days to fully recover to new highs in August of 2018. The financial news then turned to the business of trying to predict if the market correction (a 10% pullback from a recent peak) would, in fact, turn into a full-fledged bear market (a 20% pullback from the highs).

By mid-December of 2018 investors were in full-fledged panic mode — once a sell-off ramps up, you honestly don’t know how long it will last and how low it will go. The Nasdaq Composite, our tech-heavy index that held the FANG stocks Facebook, Netflix, Amazon, and Google, did move into correction mode.

The headlines full of predictions and advice to stay calm and carry on as a correction don’t necessarily mean that a bear market is around the corner. In fact, history and data make for a strong case that this recent spate of the selloff is nothing out of the norm.

The S&P 500 ended down 13.52% from the high set on September 20, prompting hand-wringing and dramatic headlines. But market pundits with cooler heads were quick to point out that big drops are a natural part of a market torn in different directions by trade tariffs, rising interest rates, the government shut-down, and over-valued stocks.

Data from the Schwab Center for Financial Research showed that there have been 22 market corrections since 1974 and only four of them – 1980, 1987, 2000, and 2007, eventually ended up as bear markets.

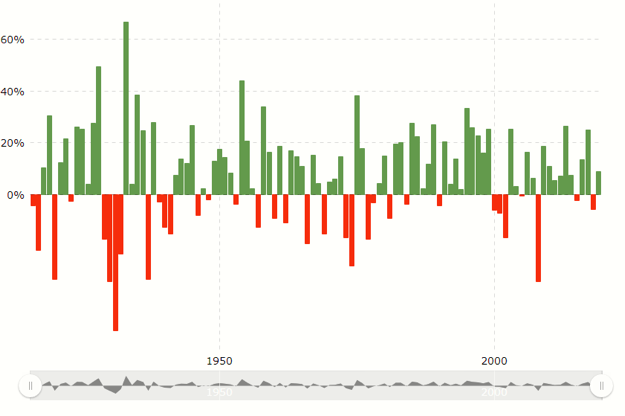

Truly, there is nothing new under the sun. Each time we hit the skids I look back over my 33-year career at the eight down years — the “red years’ that many of you have gone through with me. Below it is clear: there will always be years when you lose money if you invest in stocks.

But, look carefully before and after the red years — there is a lot of pretty good green! The last red bar was 2018, and the budding green bar on the far right is 2019. My question to you: is the green worth it all the red?

Comments